Business Insurance in and around Emory

Calling all small business owners of Emory!

Helping insure businesses can be the neighborly thing to do

Business Insurance At A Great Price!

Preparation is key for when a mishap happens on your business's property like an employee getting hurt.

Calling all small business owners of Emory!

Helping insure businesses can be the neighborly thing to do

Surprisingly Great Insurance

With options like a surety or fidelity bond, worker's compensation for your employees, business continuity plans, and more, having quality insurance can help you and your small business be prepared. State Farm agent Toni Threadgill is here to help you customize your policy and can assist you in submitting a claim when the unexpected does arise.

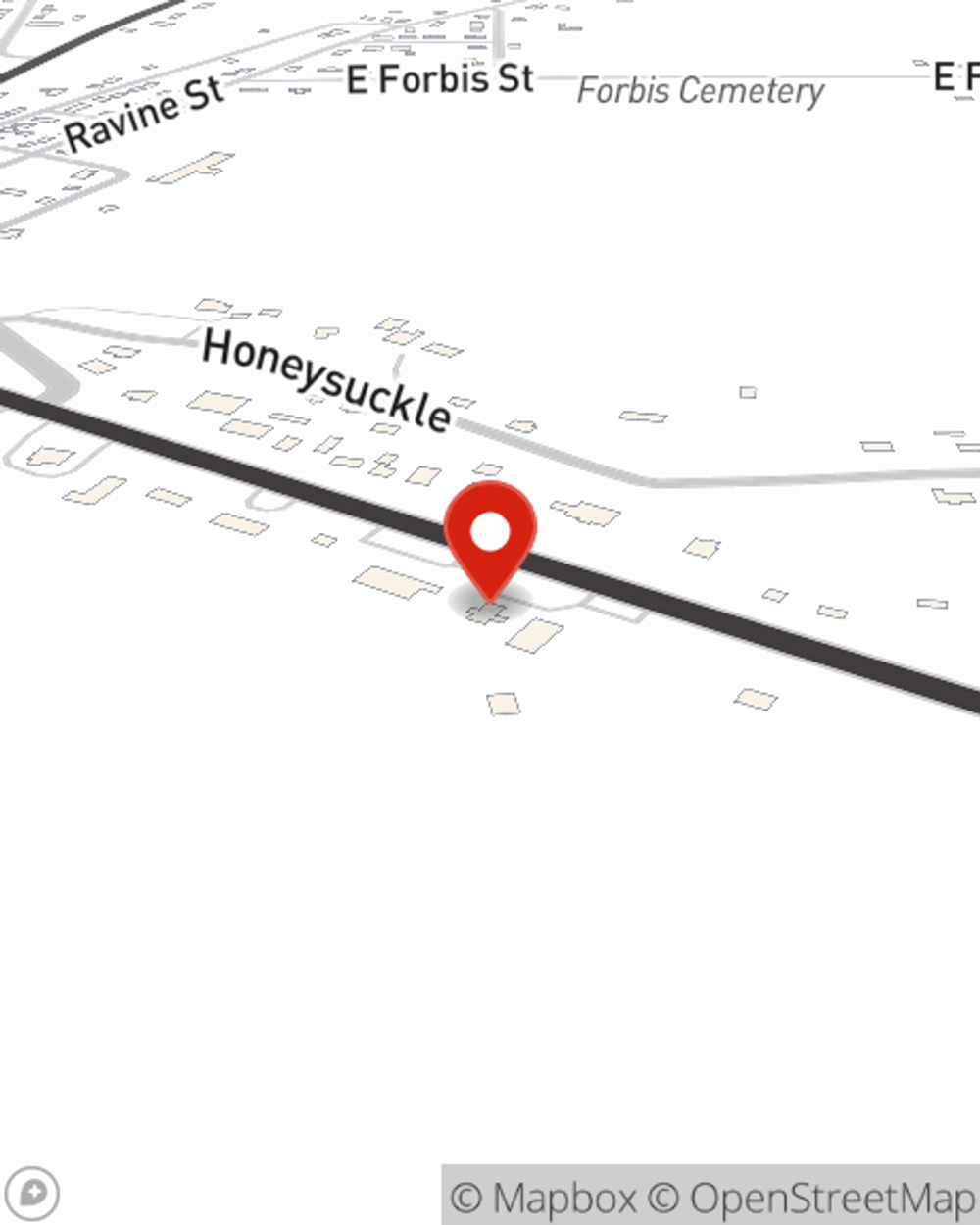

Don’t let the unknown about your business keep you up at night! Visit State Farm agent Toni Threadgill today, and discover how you can save with State Farm small business insurance.

Simple Insights®

Farm scheduling versus blanket coverage

Farm scheduling versus blanket coverage

When deciding between blanket coverage or scheduling, we have some tips that could help with the decision.

What you need to know about replacement cost vs market value

What you need to know about replacement cost vs market value

Learn the difference between replacement cost value and market value coverage to make an informed decision when purchasing home insurance.

Toni Threadgill

State Farm® Insurance AgentSimple Insights®

Farm scheduling versus blanket coverage

Farm scheduling versus blanket coverage

When deciding between blanket coverage or scheduling, we have some tips that could help with the decision.

What you need to know about replacement cost vs market value

What you need to know about replacement cost vs market value

Learn the difference between replacement cost value and market value coverage to make an informed decision when purchasing home insurance.